Special Report

Senate Republicans released a tax reform plan on November 9, 2017. Like the House GOP bill – the “Tax Cuts and Jobs Act” (HR 1) – the Senate GOP plan would impact virtually every individual and business on a level not seen in over 30 years. As with any tax bill, however, there would be “winners” and “losers.” Both the House GOP bill and Senate GOP plan call for lowering the individual and corporate tax rates, repealing countless tax credits and deductions, eliminating the alternative minimum tax (AMT), enhancing the child tax credit, boosting business expensing, and more.

Also on November 9, the House Ways and Means Committee approved, along party lines, a revised version of the House GOP bill. Republican leaders have said they are aiming to bring HR 1 to a floor vote during the week of November 13.

The White House has signaled its support for the House GOP bill. Possible roadblocks to ultimately getting a bill to the President’s desk before year end are unified opposition from Democrats, intense lobbying efforts to preserve tax breaks slated for elimination, and the significant differences in the House and Senate proposals.

IMPACT.

GOP leaders in the Senate predict that the Senate Finance Committee (SFC) will mark up a tax reform package during the week of November 13. The Senate could vote on a bill before Thanksgiving.

Taxpayers need to plan for several possible contingencies: passage of a final tax reform bill before year end, passage of the bill in early 2018, or the bill failing to move forward. The proposed changes in both the House GOP bill and the Senate GOP plan are forward-looking (after 2017) for the most part.

INDIVIDUALS

Tax Rates

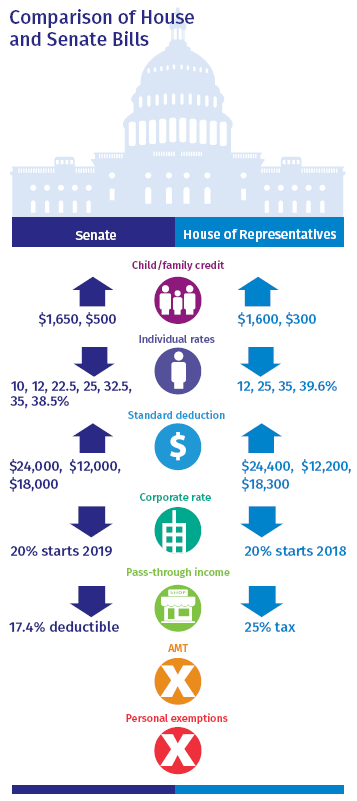

The House GOP bill proposes four tax rates: 12, 25, 35, and 39.6 percent after 2017. The Senate GOP plan calls for seven rates: 10, 12, 22.5, 25, 32.5, 35, and 38.5 percent after 2017. Under current law, individual income tax rates are 10, 15, 25, 28, 33, 35, and 39.6 percent.

The Trump/GOP Tax Reform Framework released in September contained a three-bracket structure of 12, 25, and 35 percent. The House GOP bill would keep the current top rate of 39.6 percent. The Senate GOP plan calls for a top rate of 38.5 percent.

IMPACT.

The House GOP bill and the Senate GOP plan includes proposed income ranges for their respective proposed brackets.

| Proposed House Bill Brackets | ||

| Rate | Joint Return | Individual Return |

| 12% | $0 – $90,000 | $0 – $45,000 |

| 25% | $90,000 – $260,000 | $45,000 – $200,000 |

| 35% | $260,000 – $1 million | $200,000 – $500,000 |

| 39.6% | over $1 million | over $500,000 |

| Proposed Senate Plan Brackets | ||

| Rate | Joint Return | Individual Return |

| 10% | $0 – $19,050 | $0 – $9,525 |

| 12% | $19,050 – $77,400 | $9,525 – $38,700 |

| 22.5% | $77,400 – $120,000 | $38,700 – $60,000 |

| 25% | $120,000 – $290,000 | $60,000 – $170,000 |

| 32.5% | $290,000 – $390,000 | $170,000 – $200,000 |

| 35% | $390,000 – $1 million | $200,000 – $500,000 |

| 38.5% | over $1 million | over $500,000 |

Under both the House GOP bill and the Senate GOP plan, income levels would be indexed for inflation for a “chained CPI” instead of CPI. Under the House GOP bill, the benefit of the 12-percent rate would be phased out for taxpayers in the 39.6-percent bracket.

Both House GOP bill and the Senate GOP plan do not change the current tax treatment of qualified dividends and capital gains.

IMPACT.

The House GOP bill and the Senate GOP plan do not repeal the Affordable Care Act’s taxes. Left untouched are the net investment income (NII) tax, the additional Medicare tax, the medical device excise tax, and more. On November 1, the GOP leaders of the House Ways and Means Committee and the SFC unveiled a joint proposal to repeal the ACA’s individual and employer shared responsibility provisions. Nonetheless, the House Ways and Means Committee approved the GOP bill without such repeal, and the Senate GOP plan is silent as to the provisions.

Standard Deduction

The House GOP bill calls for a near doubling of the standard deduction to $24,400 for married filing jointly and $12,200 for single filers, as adjusted for inflation using a chained CPI for 2018. Heads-of-households could claim a standard deduction of $18,300. Similarly, the Senate GOP plan calls for these amounts to be $24,000, $12,000, and $18,000, respectively. Under current law, the standard deduction absent any changes will be $13,000 for joint filers, $9,550 for heads of households, and $6,500 for single filers. The Senate GOP plan would retain the additional standard deduction for the elderly and blind.

IMPACT.

One goal of a higher standard deduction is to simplify tax filing by cutting more than half of those taxpayers who would otherwise do better itemizing deductions. Of course, that group would realize less of a tax benefit than those taxpayers who do not now itemize. Supporters argue that it effectively creates a more broadly applicable “zero tax bracket” for taxpayers earning less than the standard deduction amount.

The doubling of the standard deduction would effectively eliminate most individuals from claiming itemized deductions other than high-income taxpayers. For example, if the standard deduction for married filing jointly is $24,400, as under the House GOP bill, then only individuals with mortgage interest and charitable deductions in excess of $24,400 would claim them as itemized deductions. With fewer individuals claiming those deductions, this could have broad impact on both real estate prices and charitable organizations.

Both the House GOP bill and the Senate GOP plan eliminate the deduction for personal exemptions and the personal exemption phase-out.

Deductions and Credits

Under both the House GOP bill and the Senate GOP plan, the number of individual deductions and credits would be pruned. However, the two proposals take different approaches.

IMPACT.

The loss of many itemized deductions would channel an even greater number of taxpayers to the standard deduction. Big losers may include state and local governments that depend upon the federal itemized deductions for state and local income taxes and real estate taxes as an indirect subsidy for those taxes.

The home mortgage interest deduction would be retained, but modified under both proposals. For most debt incurred after the proposed effective date of November 2, 2017, the current $1 million limitation would be reduced to $500,000 under the House GOP bill. The Senate GOP plan retains the home mortgage interest deduction, but eliminates the home equity interest deduction.

Under the House GOP bill, the deduction for state and local income taxes would be repealed after 2017. Similarly, taxpayers would no longer be able to elect to deduct state and local sales taxes in lieu of state and local income taxes. Property taxes up to $10,000 could be deducted.

The Senate GOP plan would eliminate the state and local tax deduction. There would be no carve out for property taxes as in the House GOP bill.

The House GOP bill repeals the medical expense deduction. The Senate GOP plan preserves the medical expense deduction.

IMPACT.

Once again, the concessions for retaining some deductions are valuable only to those taxpayers who would do better continuing to itemize deductions than taking the higher standard deduction.

Family Incentives

Under the House GOP bill, the child tax credit would be increased to $1,600 and a temporary credit of $300 would be allowed for non-child dependents. A temporary family flexibility credit of $300 would be allowed with respect to the taxpayer (each spouse in the case of a joint return) who is neither a child nor a non-child dependent. The Senate GOP plan would increase the child tax credit to $1,650 and allow a $500 credit for non-child dependents.

IMPACT.

Under the House GOP bill, the phase out for the combined child credit, the non-child dependent credit, and the credit for a non-child or non-child dependent would increase to $230,000 for married couples filing joint returns and $115,000 for single individuals. Under the Senate GOP plan, these amounts are increased to $1 million and $500,000, respectively.

Under an amended version of the House GOP bill approved by the Ways and Means Committee, the adoption credit is proposed to be retained, and the Senate GOP plan makes no changes to the credit. The maximum amount of the credit in 2017 is $13,570 and is scheduled to increase to $13,840 in 2018. The House GOP bill and the Senate GOP plan retain the earned income tax credit (EITC).

Education

The House GOP bill would consolidate the American Opportunity Tax Credit (AOTC) and Lifetime Learning Credit after 2017. The Senate GOP plan makes no changes to education credits. Also, after 2017, no new contributions could be made to Coverdell education savings accounts.

The House GOP bill would repeal the student loan interest deduction and would not revive the tuition and fees deduction, which expired after 2016. The Senate GOP plan would retain the student loan interest deduction.

Retirement

The House GOP bill generally retains the current rules for 401(k) and other retirement plans. However, the House bill would repeal the rule allowing taxpayers to recharacterize Roth IRA contributions as traditional IRA contributions and the rule allowing conversion of a traditional IRA to a Roth IRA. Rules for hardship distributions would be modified, among other changes.

The Senate GOP plan would align contribution limits under 401(k), 403(b) and 457 plans. The Senate GOP plan would also make early withdrawals from 457 plans subject to the early withdrawal penalty, and would eliminate “catch-up” contributions for employees with compensation in excess of $500,000.

Initial proposals for more extensive changes to retirement plans and generate revenues appear to be off the table, at least for now. These proposals could resurface if lawmakers look for revenue raisers to help offset the costs of the tax cuts.

Federal Estate Tax

The House GOP bill, as amended and approved by the House Ways and Means Committee, calls for doubling the federal estate tax exemption and then eliminating the estate tax for decedents dying after 2024. The current maximum federal estate tax rate is 40 percent with an inflation-adjusted $5 million exclusion ($5.49 million in 2017), which married couples can combine for a $10 million exclusion ($10.98 million in 2017). The Senate GOP plan would keep the federal estate tax but increase the basic exclusion to $10 million for individuals, subject to inflation adjustments.

Alternative Minimum Tax

The House GOP bill and the Senate GOP plan call for abolishing the AMT. A parallel tax structure, the AMT, has existed for the stated purpose of ensuring that individuals, corporations, estates, and trusts with substantial income do not avoid tax liability.

IMPACT.

The House GOP bill and the Senate GOP plan include SPECIAL rules for taxpayers with AMT credit carryforwards.

BUSINESSES

Corporate Taxes

The House GOP bill calls for a 20-percent corporate tax rate beginning in 2018. The Senate GOP plan calls for a 20-percent corporate tax rate beginning in 2019. The maximum corporate tax rate currently tops out at 35 percent.

Although the current maximum corporate tax rate is 35 percent, many corporations now pay an effective tax rate that is considerably less.

Under an amendment added by the House Ways and Means Committee, the 80-percent and 70-percent dividends received deductions under current law are reduced to 65-percent and 50-percent, respectively.

Business Tax Benefits

A number of proposed changes to various business incentives are included in the House GOP bill and Senate GOP plan. Chief among them is effectively allowing 100-percent immediate expensing of qualified property for a five-year period (qualified property acquired and placed in service after September 27, 2017 and before January 1, 2023, with an additional year for certain longer production period property).

IMPACT.

The bonus depreciation rate has fluctuated wildly over the last 15 years, from as low as zero percent to as high as 100 percent. It is often seen as a way to incentivize business growth and job creation. However, some economists have found that bonus depreciation does little to motivate businesses to buy new equipment or property that they would not otherwise have bought. Instead, bonus depreciation simply creates an incentive to accelerate already planned purchases to tax years when it is available.

The House GOP bill also would temporarily increase the Code Sec. 179 expensing limitation to $5 million and the phase-out amount to $20 million for tax years beginning before 2023. Additionally, the House bill would modify the rules for deducting business interest and the rules for net operating losses.

The Senate GOP plan generally tracks the House GOP approach to expensing, although the expensing limitation is proposed to be $1 million, with a $2.5 million phase-out amount.

Deductions and Credits

Numerous business tax preferences would be eliminated after 2017 under the House GOP bill and the Senate GOP plan. These include the Code Sec. 199 domestic production activities deduction, non-real property like-kind exchanges, the Work Opportunity Tax Credit, and more. Additionally, the rules for business meals would be revised.

The House GOP bill leaves the research and development credit in place, but requires five-year amortization of research and development expenditures. The Senate GOP plan makes no changes to research and development incentives.

Interest Deductions

Both the House GOP bill and Senate GOP plan would cap the deduction for net interest expenses at 30 percent of adjusted taxable income. Exceptions would exist for small businesses.

IMPACT.

This provision is an attempt to “level the playing field” between businesses that capitalize through equity and those that borrow.

Pass-Through Businesses

Currently, owners of partnerships, S corporations, and sole proprietorships pay tax at the individual rates, with the highest rate at 39.6 percent. The House GOP bill proposes a 25-percent tax rate for pass-through income after 2017, with a nine-percent rate for certain small businesses. The Senate GOP plan provides for a 17.4-percent deduction of pass-through or sole proprietorship income.

IMPACT.

The House GOP bill proposes rules that would prevent pass-through owners—par-ticularly service providers such as accountants, doctors, lawyers, etc.—from converting their compensation income taxed at higher rates into profits taxed at the 25-percent level. Generally, 70 percent of pass-through income would be attributed to labor and the percentage would increase to 100 percent for certain service providers. The House GOP bill includes an alternative formula based on facts and circumstances. Similarly, the Senate GOP plan eliminates the 17.4-percent deduction for specified service providers with income in excess of threshold amounts.

ENERGY

The House GOP bill would repeal many current energy tax incentives, including the marginal well tax credit and the credit for plug-in electric vehicles. Other energy tax preferences, such as the residential energy efficient property credit would be modified. The Senate GOP plan does not address these incentives.

EXEMPT ORGANIZATIONS

The House GOP bill would modify the so-called “Johnson amendment,” which generally restricts Code Sec. 501(c)(3) organizations from political campaign activity. The House GOP bill would also revise reporting requirements for donor advised fund sponsoring organizations and impose an excise tax on the investment income of certain colleges and universities, among other changes. The Senate GOP plan would repeal tax-exempt status for professional sports leagues, among other changes.

INTERNATIONAL

The House GOP bill would create a dividend-exemption system for taxing U.S. corporations on the foreign earnings of their foreign subsidiaries when the earnings are distributed. The foreign tax credit rules would be modified as would the Subpart F rules. The look-through rule for related controlled foreign corporations would be made permanent, among other changes.

Repatriation

A portion of deferred overseas-held earnings and profits (E&P) of subsidiaries would be taxed at a reduced rate of 14 percent (seven percent for illiquid holdings) under the House GOP bill, as amended by and approved by the Ways and Means Committee. Under the Senate GOP plan, these amounts are 10 percent and 5 percent, respectively. Under both plans, foreign tax credit carryforwards would be fully available and foreign tax credits triggered by the deemed repatriation would be partially available to offset the U.S. tax.

IMPACT.

The lower corporate tax rate of 20 percent may also provide an incentive for businesses to not shift operations overseas going forward.